Submitting a Nil disclosure form

On this page

In NSW, candidates, groups, elected members, political parties, and associated entities must disclose political donations made and received and electoral expenditure incurred.

Third-party campaigners must disclose electoral expenditure incurred during the capped expenditure period for an election, and political donations received for the purpose of incurring that expenditure.

Electoral expenditure incurred must be disclosed annually for the 12-month reporting period ending 30 June. Political donations must be disclosed every six months for the half-yearly reporting periods ending 31 December and 30 June.

A Nil disclosure form must be submitted when:

- you have not made any political donations in the reporting period

- you have not received any political donations in the reporting period

- you did not incur electoral expenditure in the reporting period.

Only the person who is legally responsible for the disclosure is able to sign and submit the form.

Step-by-step guide

1. Login to Funding and disclosure online.

2. Go to the 'Disclosures' tab.

3. Select the ‘Start a NIL Disclosure’ quicklink.

4. Select the ‘Financial year’ of the reporting period and the ‘Disclosure type’ using the dropdown list.

5. A list of disclosure forms will appear based on your selection. Select the relevant disclosure from the list and select ‘Generate nil disclosure’ to open the form.

6. Select ‘Section 1: Details’ to review the details of the individual or entity.

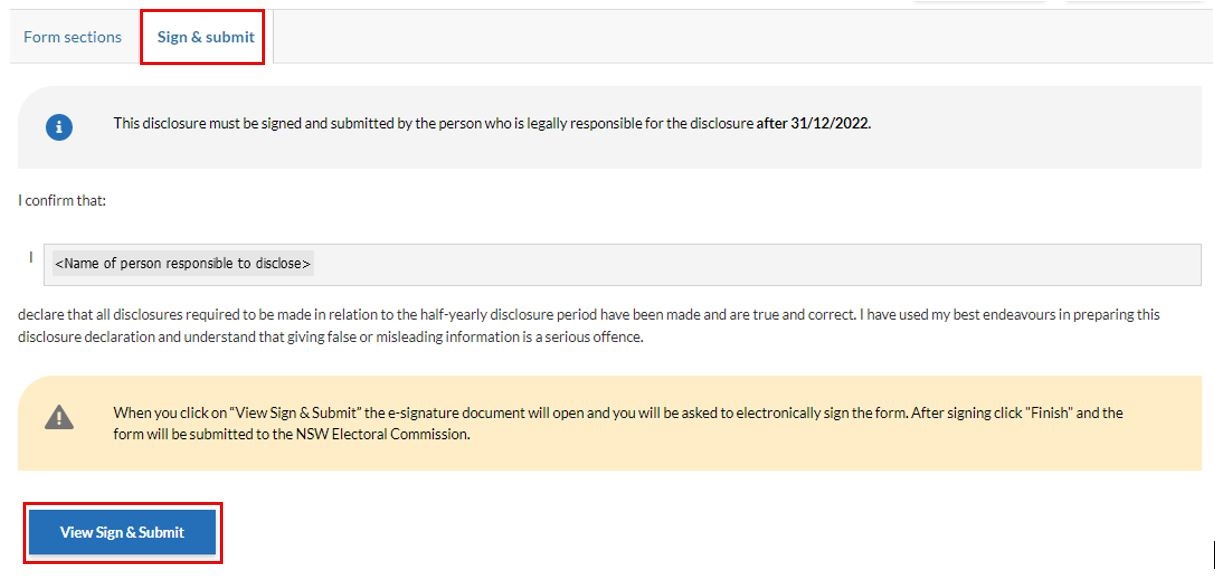

Signing and submitting the Nil disclosure form

1. You can generate a PDF copy of this disclosure and provide an e-signature by selecting ‘View sign & Submit’, provided the lodgement date for the disclosure period has commenced.

You will be redirected to DocuSign to provide an e-signature. This process can take a few minutes depending on your internet speed.

You will be redirected to DocuSign to provide an e-signature. This process can take a few minutes depending on your internet speed.

2. The first time you use DocuSign, you will be prompted to agree to its terms of use for the electronic signature functionality.

3. Once the PDF has been generated, select ‘Continue’.

3. Once the PDF has been generated, select ‘Continue’.

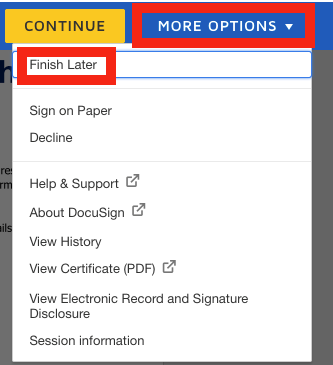

4. Review the form to make sure all the information is complete and correct. If you need to change or add information, you can navigate back to the form through ‘More Options’ and selecting ‘Finish Later’.

5. To sign the form electronically, scroll to the declaration section and read the declaration statement. Click ‘Sign’.

The date will be autopopulated based on the date the e-signature is provided.

The date will be autopopulated based on the date the e-signature is provided.

6. Add your electronic signature to the signature box by selecting ‘+ Add’ and choose to ‘Draw’ or ‘Upload’ your signature. If you have previously provided an electronic signature, this will autopopulate when ‘Sign’ is selected.

7. Select ‘Finish’ to submit your disclosure.

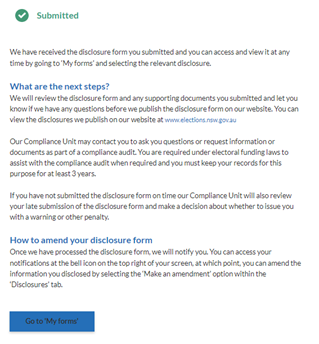

8. The disclosure is now submitted.

8. The disclosure is now submitted.

The disclosure form will be reviewed before it is published on the disclosures web page.

9. Review your submitted disclosure form by navigating to the ‘My forms’ tab and selecting ‘Disclosures’.

Submitting a Nil disclosure when a disclosure has already been created

1. An error message will appear in the event that you try to generate a Nil disclosure form for a disclosure that you have already entered information for. If you believe this information was entered in error and there is no relevant information to disclose, follow the steps outlined below.

2. Navigate to the ‘My forms’ tab on the navigational menu.

3. Scroll down to the list of disclosures and select the numbered link under the ‘Disclosure/Claim for Payment Number’ column to open the disclosure form.

4. Delete the disclosure form by selecting 'Delete form'.

4. Delete the disclosure form by selecting 'Delete form'.

5. The disclosure will be added to the list of disclosures under the ‘Generate and submit Nil disclosures’ quicklink.

6. Follow step 5 from the section above to finalise your Nil disclosure.